san antonio property tax rate 2021

San Antonio Property Tax Rate 2021. If you take the price of an average home in San Antonio 240000 and use this number in Alamo Ranch you would be looking at a yearly property tax bill of 533353.

Tax Rates Bexar County Tx Official Website

The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

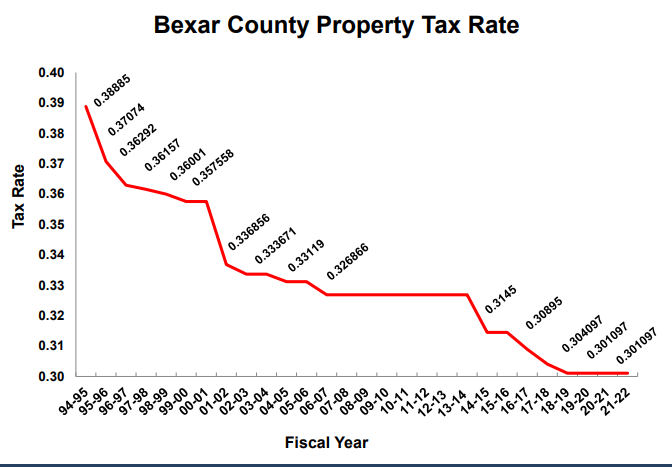

. 24 shows the gradual decrease of the countys property tax rate. CITY OF SAN ANTONIO PROPOSED ANNUAL OPERATING AND CAPITAL BUDGET FISCAL YEAR 2021 CITY MANAGER ERIK WALSH PREPARED BY. For questions regarding your tax statement contact the Bexar County Tax.

Senate Bill 2 SB2 of the 86 th Texas Legislature requires the Tax Assessor-Collector from each county to post their website the worksheets used to calculate the No-New-Revenue and Voter-Approval tax rates for the most recent five 5 years. 2021 Official Tax Rates Exemptions. Truth in Taxation Summary PDF.

A graphic shown to commissioners on Aug. 2020 Official Tax Rates Exemptions. After a contentious debate Bexar County Commissioners on Tuesday approved a 28 billion budget and a reduction in the county tax rate that will shave a.

Physical Address 100 W. Type of Property Tax Fund. Property taxes in Texas are the seventh-highest in the US as the average effective property tax rate in the Lone Star State is 169.

Beside this how much. Bexar County has one of the highest median property taxes in the United States and is ranked 282nd of the 3143 counties in order of median property taxes. Compare that to the national average which currently stands at 107.

Historical Property Tax Rate. Southside - 3505 Pleasanton Rd. Table of property tax rate information in Bexar County.

Property Tax Rate The property tax rate for the City of San Antonio consists of two components. The tax rate varies from year to year depending on the countys needs. The 2021 rate of 276237 cents per valuation is mostly unchanged from 2020s rate of 277429 cents per 100 valuation.

They are however required to pay seven other types of property tax ranging from Northside ISD taxes to Bexar County Taxes creating a total tax rate of 222 per every hundred dollars. Northeast - 3370 Nacogdoches Rd. Monday-Friday 800 am - 445 pm.

The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100. The Commissioners Court also voted Tuesday to approve the proposed tax rate of 0301097 per 100 of valuation. Jessica Phelps San Antonio Express-News.

Property Tax Rate Calculation Worksheets. San Antonio TX 78205. Northwest - 8407 Bandera Rd.

2021 Official Tax Rates. 2020 Official Tax Rates. Property taxes for debt repayment are set at 21150 cents per 100 of taxable value.

Tax Rate 100. Ad Search County Records in Your State to Find the Property Tax on Any Address. San Antonio TX 78205 Phone.

The typical Texas homeowner pays 3390 annually in. The citys revenues for 2022 is 21. Collect only 9907 of its taxes in 2021.

Bexar County commissioners approved a 178 billion budget for the 2020-2021 fiscal year on Tuesday. The decrease shown in the mo rate in 2019 and 2020 is a result of the compression from house bill 3 the states property tax relief bill. Maintenance Operations MO and Debt Service.

The san antonio sales tax rate is. Box 839950 San Antonio TX 78283. Only property taxes levied on existing properties not new developments count toward the revenue growth calculation.

The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. These balances are not encumbered by a corresponding debt obligation. Bexar County collects on average 212 of a propertys assessed fair market value as property tax.

Public Sale of Property PDF. Enter an Address to Receive a Complete Property Report with Tax Assessments More. The amounts above are based on the Citys proposed tax rate of 55827 cents per 100 of assessed valuation.

The rate shown for the 2021. SAN ANTONIO A symbolic property tax cut sparked. 48 rows San Antonio.

798721 Total debt levy. 39 rows 2021 Official Tax Rates Exemptions. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations.

Greg Abbott signed the new law Senate Bill 2 in 2019 and it took effect in 2021 when the citys property tax revenues increased by 31. Farm to MarketFlood Control Fund - Unencumbered Fund Balance The following estimated balances will be left in the units property tax accounts at the end of the fiscal year. San Antonio TX 78207.

Scott Ball San Antonio Report. Beside above how much is San Antonio property tax. The Citys FY 20 21 Proposed Budget does not include a City property tax rate increase.

Starter Home Vs Forever Home Pros Cons To Know About In 2021 Starter Home San Antonio Real Estate Home Buying Process

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Fresno Realtor Realty Fresno Homes For Sale Linda Peltz Sale House Real Estate Selling House

Sky Is Limit For Air Rights In Manhattan Manhattan Sky Air

The Best And Worst States For Retirement 2021 All 50 States Ranked Bankrate Clark Howard Life Map Retirement

Car Insurance Claim Guidelines 2021 Car Insurance Claim National Insurance Car Insurance

Find Your Next Home Berkshire Hathaway Homeservices Real Estate Information Credit Reporting Agencies Mortgage Payment

Bexar County Commissioners Approve Slightly Reduced Tax Rate For 2022

Salah Smm I Will Be Your Professional Social Media Manager For 80 On Fiverr Com In 2021 Log Cabin Cabin Vacation Home

Sending Your Cargo Overseas Is A Big Deal In 2021 Create A Chart Chart Of Accounts San Gabriel Valley

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

The Importance Of Home Equity In Building Wealth In 2021 Wealth Building Home Equity Home Ownership

Pin On 5 The Philadelphia Editor 2018 Edition

Bexar County Commissioners Approve Symbolic Property Tax Cut

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Micro Flipping In Real Estate A Complete Guide In 2021 Real Estate Wholesale Real Estate Estates