what is the tax rate in tulsa ok

Tulsa County collects on average 106 of a propertys assessed fair market value as property tax. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402.

228 W 17th Pl Tulsa Ok 74119 Realtor Com

The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective property tax rate of 106 of property value.

. 918 596-5100 Fax. State of Oklahoma - 45. Has impacted many state nexus laws and sales tax collection requirements.

You can find more tax rates and allowances for Tulsa County and Oklahoma in the 2022 Oklahoma Tax Tables. 325 of taxable value which decreases by 35 annually. 325 of ½ the actual purchase pricecurrent value.

2 to general fund. Oklahoma is ranked 972nd of the 3143 counties in the United States in order of the median amount of property taxes collected. 074 of home value.

Tulsa County Headquarters 5th floor 218 W. Wright Tulsa County Assessor. A county-wide sales tax rate of 0367 is applicable.

New and used all-terrain vehicles utility vehicles and off road motorcycles. The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200. Oklahoma State Tax Quick Facts.

The state sales tax rate in Oklahoma is 4500. Yearly median tax in Tulsa County. Learn all about Tulsa County real estate tax.

With local taxes the total sales tax rate. The median property tax in Oklahoma is 79600 per year for a home worth the median value of 10770000. Warrants issued on delinquent personal tax 1000 Certificates issued on October lien sales 1000 Individual Redemption fee 500 Lien Fee on Delinquent Personal Property Tax 500 Tax Deed issuance 1000 Certified Mail Fee on Notice of Sale of Real Estate For delinquent tax 500 postage Insufficient check charge 3500.

Tulsa County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Oklahoma has one of the lowest median property tax rates in the. The Tulsa County sales tax rate is.

Use tax is 365. This is the total of state and county sales tax rates. Tulsa OK 74119.

Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037. Tax amount varies by county. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is.

Yearly median tax in Tulsa County. Counties in Oklahoma collect an average of 074 of a propertys assesed fair market value as property tax per year. The current total local sales tax rate in Tulsa OK is 8517.

4 rows The current total local sales tax rate in Tulsa OK is 8517. Sales tax at 365. The US average is 46.

This is also in addition to the State Tax Rate of 45. You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables. The 2018 United States Supreme Court decision in South Dakota v.

Who is exempt from the tax. Wright Weighted Averages Skiatook 10468 Skiatook 99 37 Skiatook 11454 to 11539 Sperry 11142 Caney Val 9447 Washington County Collinsville 115139 Owasso 112152 Oologah-Talala 10425182 Collinsville 9921 Owasso 11102 2016 6132 8874 9086 9608 10039. 16 rows The Tulsa County Sales Tax is 0367.

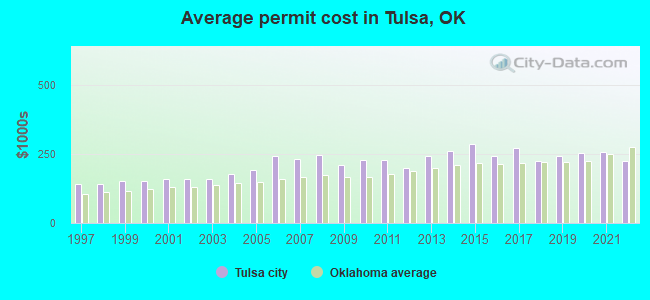

The City of Tulsa imposes a lodging tax of 5 percent. The City has five major tax categories and collectively they provide 52 of the projected revenue. In 2019 total mill rates in Tulsa County ranged from a low of about 61 mills to a high of about 132 mills.

4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367. The December 2020 total. 4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367.

The Oklahoma state sales tax rate is currently. City Tax Rates Layout 003 CY 2021 City Tax Rates for Tulsa County Tulsa County Assessor John A. Tulsa County - 0367.

The tax must be paid on the occupancy or the right of occupancy of rooms in a hotel. Whether you are already a resident or just considering moving to Tulsa County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. 325 of 65 of ½ the actual purchase pricecurrent value.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

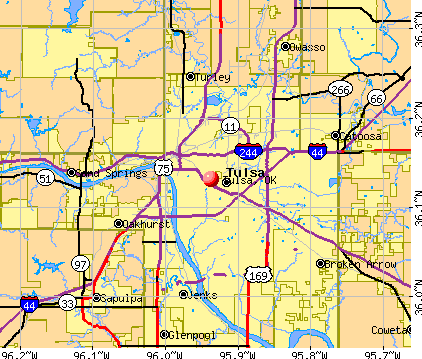

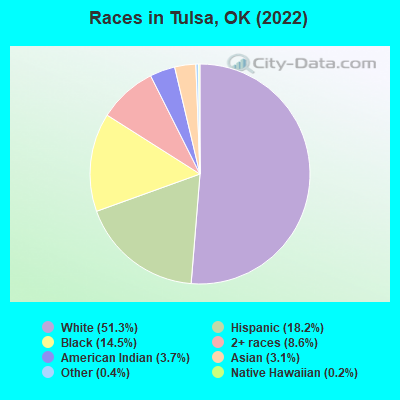

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Aqua Lily Pad Lake Fun Floating In Water

Map Of Tulsa Oklahoma Area What Is Tulsa Known For Best Hotels Home

Best Assisted Living In Tulsa Ok Retirement Living

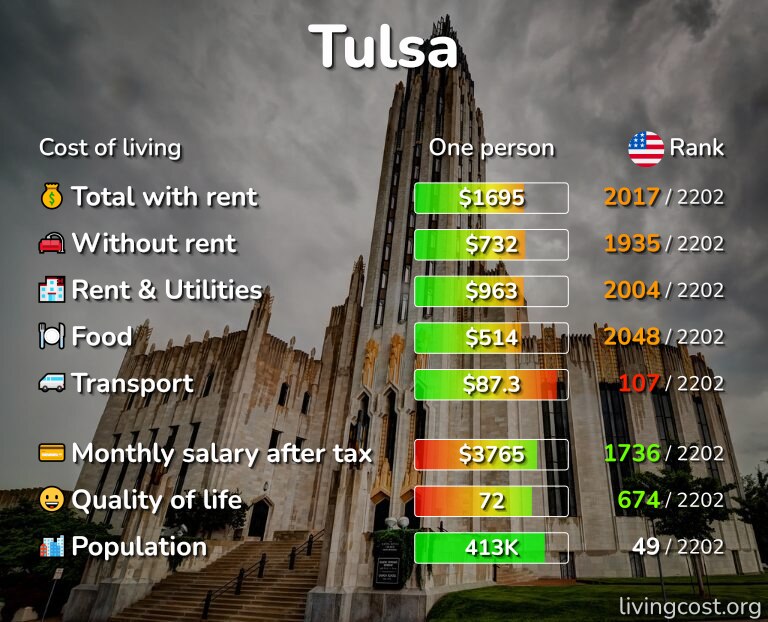

Tulsa Ok Cost Of Living Salaries Prices For Rent Food

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Pictures Download Free Images On Unsplash

The Plaza Shopping Center Price Edwards And Company

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

Tulsa Oklahoma Pictures Download Free Images On Unsplash

River Spirit Casino Resort Updated 2022 Prices Hotel Reviews Tulsa Ok

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Pictures Download Free Images On Unsplash