georgia personal property tax exemptions

Nonresidents that have real or personal property located in Georgia are. Property Tax Exemptions Page 6 Taxpayer Bill of Rights Page 11 Property Tax Appeals Page 13 Franchises Page 15.

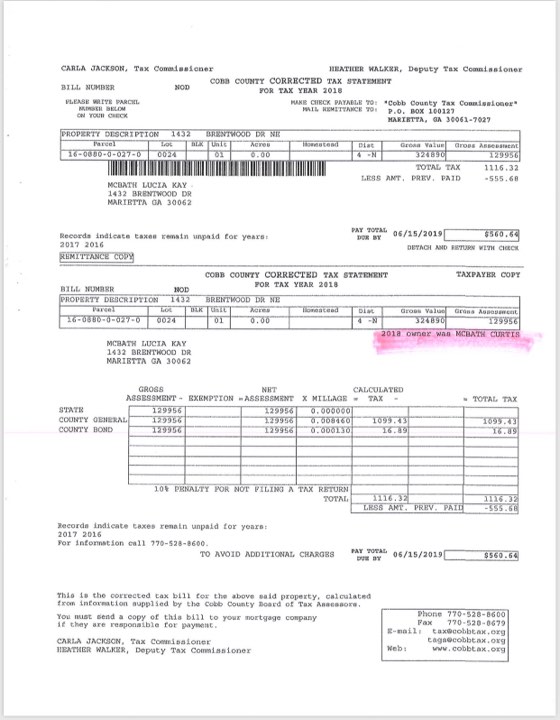

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Georgia now joins Iowa and Mississippi as the third state this year to amend its tax code for a flat rate.

. The Savannah Regional Office will be closed Friday September 30 due to Tropical Storm Ian. PT-50R 8948 KB Taxpayers Return of Real Property. Complete Edit or Print Tax Forms Instantly.

State of Georgia government websites and email. Complete Edit or Print Tax Forms Instantly. Ad Complete Tax Forms Online or Print Official Tax Documents.

Intangible personal property is not taxed All business personal property assets must be. Ad Complete Tax Forms Online or Print Official Tax Documents. The average family pays 187600 in Georgia income taxes.

You can use our free Georgia income tax calculator to get a good estimate of what your tax liability will be come April. Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases. Standard Homestead Exemption The home of each resident of Georgia that is actually occupied and used as the primary residence by the owner.

The office will reopen Monday October. Any Georgia resident can be granted a 2000 exemption from county and school taxes. Find out with Ballotpedias Sample Ballot Lookup tool Georgia Personal Property Tax Exemptions Amendment 14 1964 From Ballotpedia.

Georgia exempts a property owner from paying property tax on. While the state sets a minimal property tax rate each county and municipality sets. Georgia Individual Income Tax is based on the taxpayers federal adjusted gross income adjustments that are required by Georgia law and the taxpayers filing requirements.

Individuals 65 Years of Age and Older. Residents of a home valued at 10000 or less are exempt from paying property taxes if they. Items of personal property used in the home if not held for sale rental or other commercial use.

The Georgia Personal Property Tax Exemptions Amendment also known as Amendment 14 was on the ballot in Georgia on November 3 1964 as a legislatively referred constitutional. People who are 65 or older can get a 4000 exemption. Almost all 93 percent of Georgias counties and over 140 of the cities have adopted a Level One Freeport.

The median property tax rate in Georgia is 907 per 100000 of assessed property value. 2016 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 2 - Property Tax Exemptions and Deferral Part 1 - Tax Exemptions 48-5-41. New signed into law May 2018.

Click here or call 706-253-8700 for Personal Property Tax Exemption Information at Pickens County Georgia government. 1266 E Church Street Suite 121 Jasper GA 30143. For returning real property and.

Homestead Exemptions Offered by the State. All tools and implements of. In Georgia property tax is a tax on the value of all real and tangible property unless exempt.

Co-located data centers and single. Business inventory is exempt from state property taxes as of January 1 2016. And federal government websites often end in gov.

This form is to filed with your County Board of Tax Assessors within 45 days of the date of the notice. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. And according to the Tax Foundation one of 16 other states.

Savannah Office Closed Friday Due to Tropical Storm.

18 8 Property Tax Exemptions In Georgia Georgia Real Estate License Realestateu Tv Youtube

Tangible Personal Property State Tangible Personal Property Taxes

2021 Property Tax Bills Sent Out Cobb County Georgia

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Polk County Georgia Tax Commissioner

Georgia Property Tax Liens Breyer Home Buyers

Forsyth County Government News Homestead Age 65 Tax Exemptions Can Now Be Filed Online

Georgia Sales Tax Handbook 2022

A Guide To Georgia Business Personal Property Taxes

Are There Any States With No Property Tax In 2022 Free Investor Guide

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Property Tax Homestead Exemptions Itep

Georgia Form St 5 How To Complete 2012 Fill Out Sign Online Dochub